How to Calculate the Equity in Your Leased Car

Family-friendly crossovers, like this Hyundai Santa Fe, are popular used car choices and are likely to see positive equity towards lease-end.

If you’re nearing the end of your lease, don’t simply return the car.

Depending on your vehicle’s mileage, condition, and other factors, you could be sitting on hundreds, if not thousands of dollars, in lease equity. But what is lease equity, and more importantly, how do you calculate the amount of equity in your leased car?

What is Lease Equity?

First, let’s understand how leasing works.

When you lease a car, you’re largely paying for its depreciation. For example, if the selling price of the car was $30,000 new, and the lender set a 36-month residual value of $21,000, then the total depreciation expense is $9,000 over the course of the lease (or $250 per month).

Your lease payment is made up of this monthly depreciation expense, plus finance charges and taxes.

At the end of the lease, you have the option of returning the car, or you can buy the car outright by paying a predetermined amount (in this example, the residual value of $21,000).

However, due to the global microchip crisis and the resulting new vehicle shortage, cars at the end of their lease are now often worth more than the residual value originally set by the lender. If that’s the case, then you have positive lease equity.

You can capitalize on this positive equity by buying out the vehicle at the predetermined price and selling it for a profit. Or, better yet, you can sell the leased car directly to a third-party dealer (if allowed by the lender) or via Equityhackr without first buying the car and paying the required sales tax.

It’s also possible you may have positive equity even before the end of your lease, but that likelihood generally increases closer to lease maturity.

Check your lease equity via Equityhackr now!

How Do I Calculate My Lease Equity?

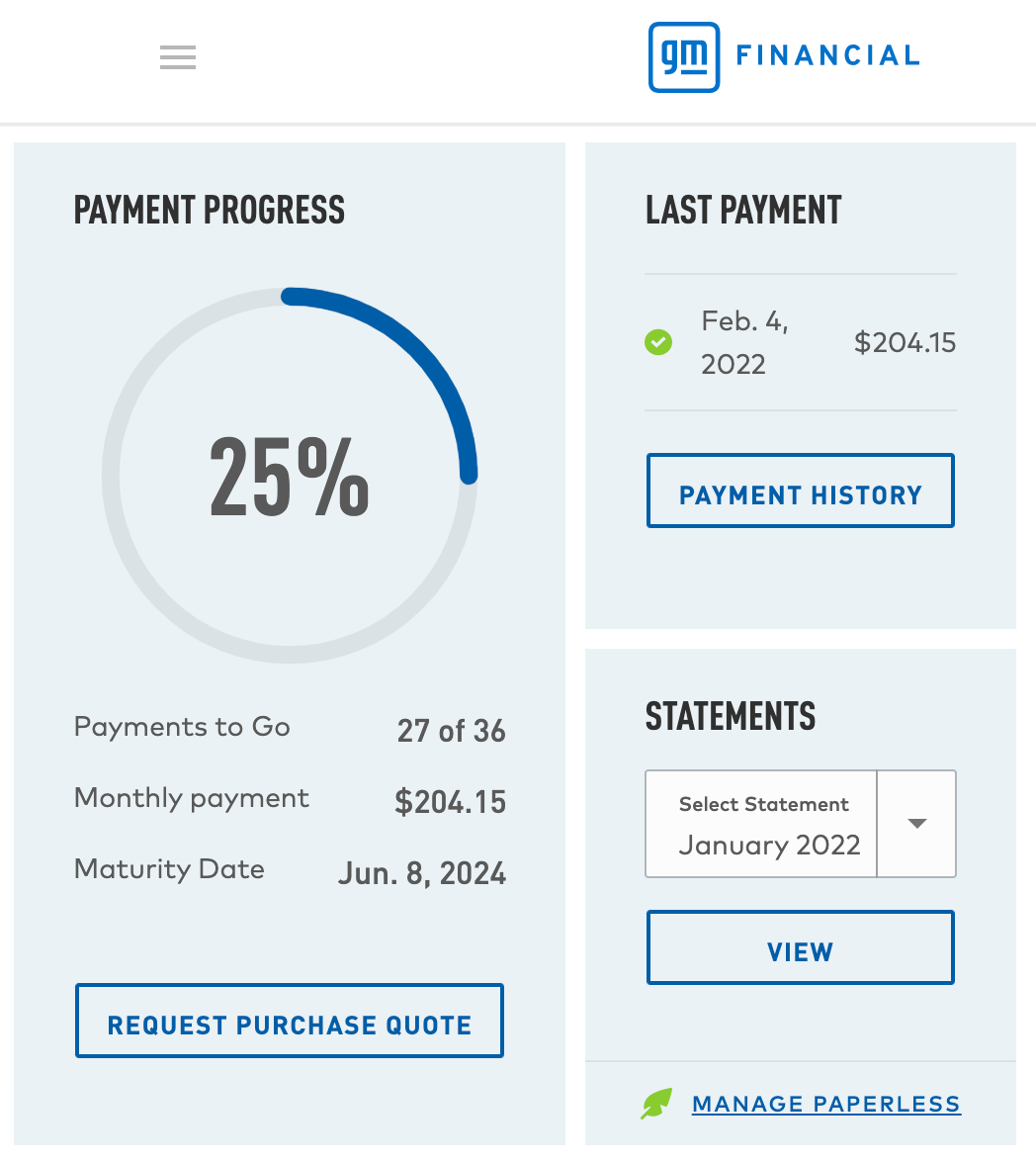

Example of the GM Financial portal, which can be used to obtain a purchase quote.

It’s quite simple. Your lease equity is the difference between the current lease payoff and the price you sell the car for.

To find your current payoff amount, log in to your lender’s online portal, or call your lender to request a purchase quote.

Note that some lenders include sales tax in their purchase quotes. If you do not need to pay sales tax (e.g., you’re using Equityhackr in which you’re selling the leased car to a third-party without first buying it), then the actual payoff amount may be lower, resulting in higher equity.

Also note that most lenders have started restricting third-party dealerships from buying out leases, making it difficult for consumers to access their lease equity. (Unlike Carvana, Vroom, or CarMax, Equityhackr works even for brands that have restricted third-party buyouts.)

However you decide, it’s worth spending a few minutes to check if you have positive lease equity before returning your lease.

Have any questions about lease equity? Join the conversation today on Leasehackr Forum.